There quite a several reasons for getting into bad credit personal loans. Some borrowers are unfit to observe the proper loan process in documentation and inability to meet all the lending company asks. To compare bad credit loans incurred among various lending institutions will spare you from getting into the same mistake of falling into an imperfect credit loan application. Study the requirements and the loan contract of the different lending companies and compare the bad credit loans which most clients have gotten in.

If you compare bad credit loans, focus on the payment schemes of the personal loan packages they offer. Default payments are often the reason behind a deficient credit standing of the borrower. It will be practical to take into consideration the leniency of the payment scheme of a credit company. There are lending companies that impose higher penalties and surcharges for default payments, which cause failure on the part of the borrower to cope with late payment. Bad credit loans will usually demand higher interest, more documents, and additional requirements in contrast to loans.

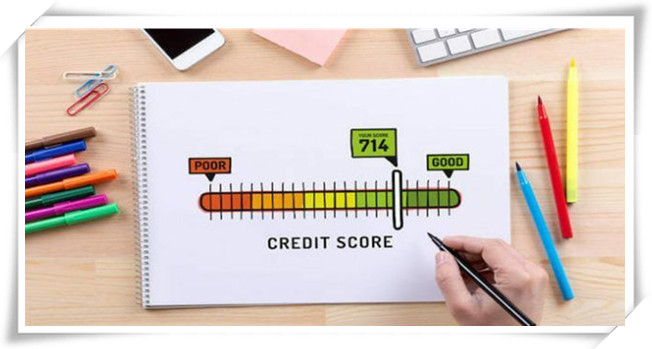

In every kind of loan, the idea of making up to the mark payments throughout the loan duration should be your focus to earn good credit points.

If an urgent financial need arises and aware of your low credit standing, compare bad credit loans of every credit and lending institution that you know, including banks. Gather all the potential documents that can support your financial capacity to pay on-time with the amount you are borrowing. Anyone with bad credit or even with no good credit to speak of can always start with bad credit personal loans. These bad credit loans will be the first ideal step to establish a good credit standing and acquire credit scores that qualify you for other higher loan packages.